The trading world is expanding faster than ever, with investors demanding platforms that go beyond just buy-and-sell options. They want speed, transparency, and access to financial services under one roof. That’s where MyFastBroker com has stepped up as a modern solution.

This platform isn’t simply a trading tool—it’s a gateway that combines market access, brokerage services, financial advice, and educational resources into a single streamlined experience. Whether you’re a beginner learning the ropes or a professional chasing precision, MyFastBroker com is built to support every stage of your financial journey.

What Is MyFastBroker com?

At its core, it is an AI-powered online trading and financial services platform. It provides tools for investing in stocks, forex, cryptocurrencies, and commodities while also offering financial products such as home loans, mortgages, and insurance.

What makes it unique is the integration of technology with advisory services. Users not only get access to real-time trading data but can also connect with specialized brokers—whether they’re stock, mortgage, insurance, or loan experts. In this sense, MyFastBroker com is both a trading platform and a financial marketplace.

The Key Features of MyFastBroker com

The success of MyFastBroker com lies in the way it blends accessibility with sophistication. Its standout features include:

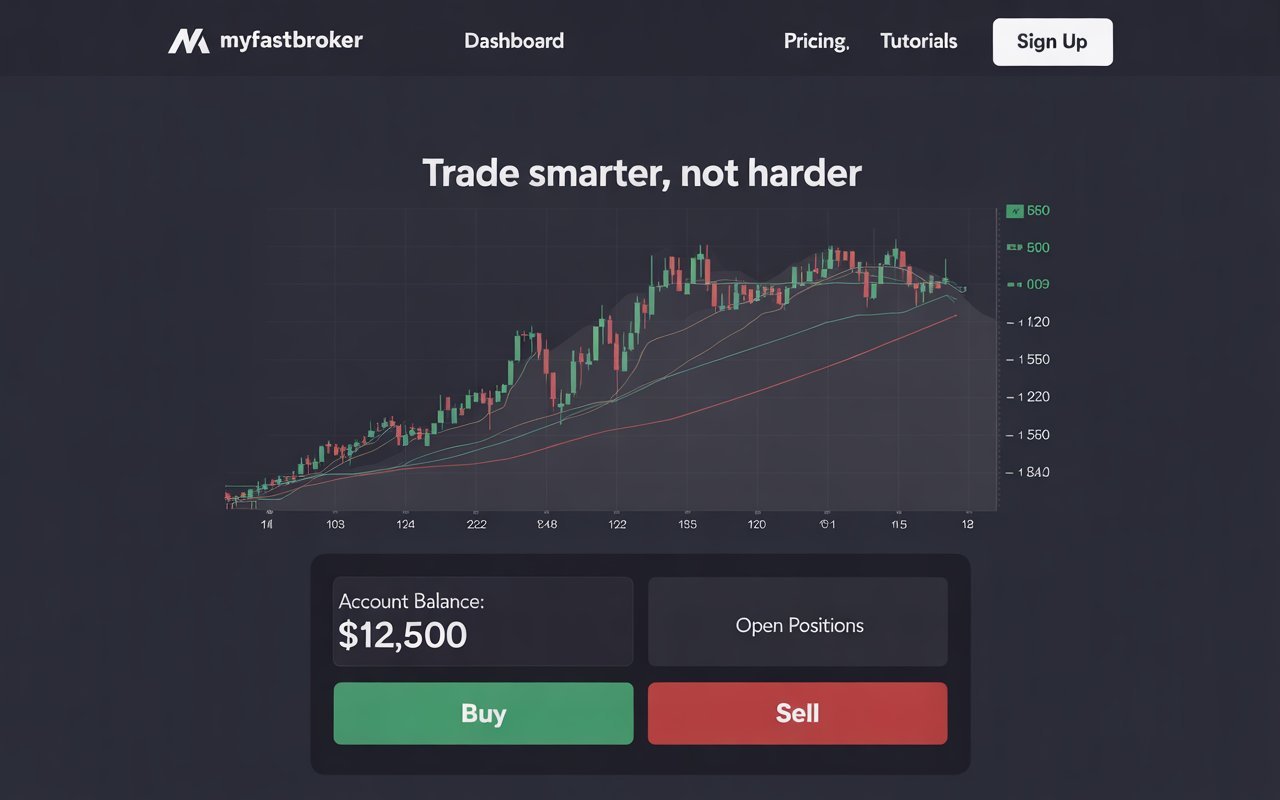

- User-Friendly Dashboard: Intuitive design that caters to both beginners and seasoned investors.

- Multiple Trading Options: Access to forex, equities, digital assets, and raw materials in one place.

- AI-Driven Analytics: Smart insights and predictions powered by artificial intelligence.

- Secure Transactions: Multifactor authentication and encryption protect user data.

- Educational Resources: Training sessions, tutorials, and demo accounts for practice.

This balance of technology, education, and safety makes MyFastBroker com particularly appealing to traders who want more than a basic platform.

What MyFastBroker com Offers Beyond Trading

Unlike many platforms that stop at market access, it extends its services into broader financial solutions. Through its network of brokers, users can explore:

- Stock Investments with personalized guidance.

- Home Loans and Mortgages tailored to specific needs.

- Insurance Coverage designed for cost efficiency and security.

- Loan Solutions from authorized banks and credit companies.

- Business Brokerage Services to help with buying or selling private businesses.

This full-spectrum approach means users don’t have to juggle multiple platforms—they can trade, invest, borrow, and insure all in one ecosystem.

The Advantages of Using MyFastBroker com

Users often highlight how much time MyFastBroker com saves. Instead of bouncing between trading apps, mortgage calculators, and insurance portals, everything is centralized. This integration also leads to better decision-making, as traders can compare options and act with greater confidence.

Security is another strength. With AI monitoring and multifactor verification, the risk of breaches is minimized. Transparency is also emphasized—clear fee structures and straightforward account upgrades make it easier for users to plan financially.

Finally, its educational support stands out. From demo accounts for beginners to advanced market analysis for experts, MyFastBroker com ensures users never feel lost in the complexity of trading.

Potential Drawbacks to Consider

Like any platform, it has its challenges. Some users note that during peak trading hours, system responses can slow down. Fees for premium accounts may also be high for budget-conscious investors. Additionally, the lack of free trials makes it harder for first-time users to test the platform risk-free.

That said, these drawbacks don’t overshadow the platform’s overall reliability. They simply highlight areas where careful consideration is needed before investing significant funds.

Why Traders Choose MyFastBroker com

For many traders, the appeal lies in how MyFastBroker com bridges traditional finance with modern technology. It’s not just about quick trades; it’s about building a financial strategy that includes investments, protection, and growth opportunities.

By connecting directly with verified brokers, users gain an extra layer of trust. The AI tools help filter through data noise, allowing for faster, smarter decision-making. And with the added benefit of educational support, MyFastBroker com positions itself as both a trading partner and a mentor.

Final Words

If you’re seeking a trading platform that goes beyond the basics, it is worth serious consideration. It offers the speed and features modern traders demand while also catering to broader financial needs like mortgages and insurance.

While premium fees and system slowdowns may be concerns for some, the platform’s advantages in transparency, security, and breadth of services make it a strong competitor in today’s digital trading space.

For traders who want a single solution to manage both investments and financial planning, MyFastBroker com delivers exactly that—a comprehensive, reliable, and innovative environment to grow wealth securely.

FAQs About MyFastBroker com

What is MyFastBroker com used for?

It’s an online platform for trading stocks, forex, cryptocurrencies, and commodities while also providing financial services like loans and insurance.

Is it suitable for beginners?

Yes. It offers demo accounts, tutorials, and a user-friendly interface for new traders.

Does MyFastBroker com provide broker services?

Yes. It connects users with stock, mortgage, loan, insurance, and business brokers.

How secure is MyFastBroker com?

It uses AI-integrated security and multifactor authentication to safeguard user data.

What are the main drawbacks?

Some users report slowdowns during peak hours, and fees may be high for premium accounts.

Can I use it internationally?

Yes, it is accessible to traders and investors across multiple countries, depending on local regulations.